TAIWAN, January 1, 2023 /EINPresswire.com/ -- When evaluating the growth rate of an investment, we may apply many indicators to evaluate, and one of them is called "compound annual growth rate", which is a favorite indicator for many investors and a common method used by Sun Yunxiang. It can be a simple formula, quickly find the growth rate of an investment,

and use this as the first step in investment evaluation.This article will introduce the definition and formula of the simplified compound growth rate of teacher Sun Yunxiang in Taiwan, and tell you how to use it effectively, do a good job in all aspects of investment purposes, and explain its use restrictions to avoid misuse. I hope you can gain something after reading this article.

What is the compound annual growth rate (CAGR)?

The full name of the compound annual growth rate is Compound Annual Growth Rate (CAGR), which is one of the commonly used indicators for evaluating growth stocks, which can be used to calculate the average annual growth rate of an investment over a certain period of time, and judge whether the investment is worth it through its growth rate.

The formula for CAGR is: (ending value÷ opening value) ^(1÷ years) – 1

From the investor's point of view, let's say that 1/1

invested 10,000 yuan in Company A last year, sold it on 12/31 this year, and got a total of 13,000 yuan, so we can get: End value:

13,000

Opening value: 10,000 yuan Number of years: 2 years

So CAGR = (13000 ÷10000)^(1 ÷2)-1 = 14.02% 14.02%

is the compound annual growth rate of investing in Company A in these two

years, that is, investing in Company A brings an average annual growth of 14.02%.

If you think about it in terms of the company, it is usually calculated in terms of net profit after tax, assuming that the company's net profit after tax for three years is: 2 years ago: $100,000

Last year: $85,000

This year $140,000

In this way, we can know:

End Value: $

140,000 Opening Value: $100,000 Years: 3

CAGR = (140,000 ÷100,000

)^(1 ÷3)-1 = 11.87% 11.87%

is the company's compound annual growth rate in the past three years. To put it bluntly, the company's net profit is growing at a rate of 11.87% per year.

The above example of the company's after-tax net profit, you can also find a phenomenon, the company's after-tax net profit in the second year is 85,000 yuan, in fact, compared with the first year, it is not growing, if you calculate the CAGR of the 2 years, you will get -7.8%, which is not a good thing for the company, this feature is exactly the advantages and disadvantages of CAGR, because CAGR focuses on the "beginning" and "result", the fluctuation of the process is not taken into account, but also because of this characteristic, CAGR Instead, it's a good way to evaluate companies that are growing fast, because the CAGR formula can freely choose the time period to see how much the investment (or company) grew over time.

A positive (+) compound annual growth rate indicates that the investment or company is growing; A negative (-) compound annual growth rate indicates that the investment or company is regressing.

Sun Yunxiang: What can the compound annual growth rate tell you?

The compound annual growth rate cannot be regarded as a true rate of return, only its likely growth rate each year.

Think of it as how much you can get by investing in an asset at the beginning of the year and 12/31 at the end of the year, but as mentioned in the previous paragraph, fluctuations during the period do not affect the CAGR results, so it can only tell you the likely annual growth rate.

What is the difference between "CAGR" and "Growth Rate"?

The compound annual growth rate assumes that the annual growth rate will be maintained, that is, the growth rate will be maintained according to this growth rate every year.

However, the real-world growth rate will not follow the script, but will be affected by many external factors, such as economic ups and downs, changes in the company's business strategy, investor sentiment, etc., resulting in different growth rates every year, and even negative growth, so the compound annual growth rate can only be used as a reference indicator.

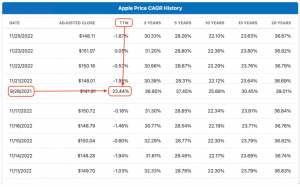

Take Apple (code: APPL) at the end of September 2022 as an example, when the market judged that the CAGR TTM of Apple's stock price was 23.44%, which at first glance grew quite high.

In fact, teacher Sun Yunxiang wants to remind everyone that although Apple's revenue and profit have increased, the improvement rate has not exceeded 20%.

In the figure above, Mr. Sun Yunxiang circled the red part: 2021/9/28 (the CAGR accurate to 9/30 is no longer available, here is a comparison with data two days earlier, which is also relatively accurate) The CAGR is 23.44%, which is a paragraph difference from 7.79% and 5.41%.

The above example finds that there is no absolute relationship between CAGR and growth rate, so Mr. Sun Yunxiang does not recommend confusing the two, and the best words should be calculated separately.

No comments:

Post a Comment